Contents

It will also help you calculate how much interest you’ll pay over the life of the loan. The average 15-year fixed-mortgage.

30 Yr Mortgage Rate History Home Purchase Rates Refinance Rates Mortgage Calculators Mortgage Rates history mortgage glossary Home Equity Loans.. Mortgage Rates History 30 Years Fixed 30 Year Fixed-Rate Mortgages Since 1971. Compiled by Freddie Mac : 2013. 2012. 2011 . 2010 . 2009 : Rate: Pts: Rate: Pts: Rate: Pts: Rate.

It can be fixed (otherwise known as a fixed-rate mortgage, or FRM), or adjustable (otherwise known as an adjustable rate mortgage, or ARM). The calculator above is only usable for fixed rates. For ARMs, interest rates are generally fixed for a period of time, after which they will be periodically adjusted based on market indices.

Zero Point Mortgage Rates – Historic Mortgage Rates – FHFA / Freddie Mac / MBA – Compare Lender Rates – Mortgage Calculators. tooltip text: mouse over any series or point. Zoom: Click and drag area to zoom.

A 15-year mortgage loan calculator is used for a wide range of reasons. As a borrower, you can use it to calculate how much you’ll pay monthly on a 15-year home loan. Mortgage loan calculators can also generate current interest rates that mortgage lenders are charging for 15-year loans for a new home.

Rates and program information are deemed reliable but not guaranteed. Rates on this page are based on the purchase of a single-family, single-unit, detached, primary residence located in Richmond, VA (home of SunTrust Mortgage, A Division of SunTrust Bank). Rates also assume a 30 day lock and are subject to change without prior written notice.

Current Refi Rates 15 Year Depending on your situation, refinancing to a 15-year mortgage could either improve your financial situation or make it harder to reach your other financial goals. Here are some of the major factors to consider when determining if a 15-year mortgage is right for you.

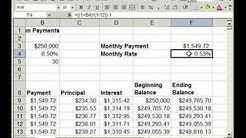

15 Year Fixed Rate Mortgage Calculator – Visit our site and calculate your new monthly mortgage payments online and in a couple minutes identify if you can lower monthly payments.

30 Yr Interest Rates Today 30 Yr Fixed Rate Trend The average for the month 4.12%. The 30 year mortgage rate forecast at the end of the month 4.14%. mortgage interest Rate forecast for November 2020. maximum interest rate 4.40%, minimum 4.14%. The average for the month 4.24%. The 30 Year Mortgage Rate forecast at the end of the month 4.27%. 30 year Mortgage Rate forecast for December 2020.30-Year Fixed Mortgage Rates . If you qualify for a 30-year fixed-rate mortgage, you’ll make the same fixed payments over the course of 360 months to pay for your home. With a fixed-rate mortgage your interest rate doesn’t change over the life of the loan. If you lock in a rate of 3.75%, it will stay 3.75% over the course of 30 years.

15-Year VA Fixed Conforming Mortgage from PenFed for qualifying U.S. Military Veterans and home purchases or refinances of more than $25,000 up to $453,100.

A 15 Year Fixed Rate Mortgage is a loan with the same interest rate and monthly payment over the 15 year life of the loan. You generally pay a lower interest rate, pay less interest over the life of the loan, and build equity more quickly with a 15 year loan than with a loan carrying a longer term.

Fixed-rate, 15-year mortgages are calculated the same way a 30-year mortgage is calculated. The only difference in the calculation is the number of total payments you’ll make over the life of the.

Fixed-rate, 15-year mortgages are calculated the same way a 30-year mortgage is calculated. The only difference in the calculation is the number of total payments you’ll make over the life of the.

15-Year Fixed Rate Mortgage Calculator. Our 15-Year Fixed Rate Mortgage Calculator is designed to help you calculate your monthly payments and the precise amount, in dollars, of interest you will be charged throughout the mortgage.