Contents

Commercial Loans, Cap Rates, and commercial loan constants – A loan constant is merely the monthly payment on a loan of exactly $1,000, fully-amortized over 30 years. For example, the loan constant at 4.25% is $4.90 per month. In other words, if you borrowed exactly $1,000 at 4.25% interest, and if you made $4.90 per month payments for 30 years, your $1,000 loan would be completely paid off.

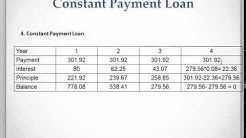

The loan constant, also known as the mortgage constant, is the calculation of the relationship between debt service and loan amount on a fixed-rate commercial real estate loan. It is the percentage of the cash paid to service debt on an annual basis divided by the total loan amount.

· However, extending the repayment term on a loan with a constant interest rate and APR increases the total financing and repayment cost as seen in the example below. In this scenario, consider a 20 and 30-year mortgage, with the same interest rate and APR:

Federal student loan interest rates for undergraduates is 4.53% for the 2019-20 year. With good credit, you may be able to refinance to get a lower rate.

A higher MCLR will effectively mean a higher home loan interest rate and thereby, a high-interest burden, keeping other factors constant. All banks carry their MCLR rates on their websites and one may.

A higher MCLR will effectively mean a higher home loan interest rate and thereby, a high-interest burden, keeping other factors constant. All banks carry their MCLR rates on their websites and one may.

Loans grew 6 per cent in constant-currency terms to Singapore dollar 345 billion. a record singapore dollar 63 billion as Singapore banks benefited from higher interest rates. “We believe the.

Loan Constant Cap Rate Cash on Cash Return. $500,000 loan with a 5% interest rate = $32,209.32 in payment per year (assuming a 30 year.

Loans made in the past at relatively high interest rates have been replaced by new loans with lower interest rates as well as by low-yielding reserves and securities. For more information and analysis about the recent behavior of net interest margins, see the articles ” Why Are Net Interest Margins of Large Banks So Compressed? ” 1 and.

It is in the interest of. offers to pay the loan outstanding in case of death off the borrower. The sum assured falls in line with the loan outstanding. In case of moratorium of five or seven years.